Tax season has begun. Though preparing for taxes may get stressful, SC Thrive is here to assist you with an easy and secure tax filing experience! Filing through Thrive Hub offers eligible South Carolinians the option to file online for FREE. Before starting the filing process, you should gather all the documents with your tax information. You can find a documents checklist HERE. Are you ready to file? Get started with this step-by-step guide on filing in Thrive Hub

Step 1. Create an Account

Creating a Thrive Hub account is simple. Our web-based platform features a single sign-on and is easy to use, secure and confidential. Need help creating an account? Find out how to set up an account in this registration video HERE. Individuals that already have an account can log in HERE.

After you create an account and you’ve logged in, you’ll be sent to the eligibility screener to determine your eligibility for SC Thrive’s free tax filing service.

If eligible, you’re then directed to Tax Slayer. To receive free tax filing, you must start your filing process in Thrive Hub, or else you will be charged.

Now you’re ready to complete the following steps to file your return.

Step 2. Log-in

- If you are a new user, create a Thrive Hub account by clicking the “Click here” hyperlink to complete the sign-up form. Select your city, county, and state from the drop-down lists.

- New users must review and accept the Consent to Release Information statement by clicking Agree.

- Your account will need to be verified. Thrive Hub will email the email address used to create your account. Click the Confirm link in the email.

- The Confirm link will take you to a link to set up your password for Thrive Hub. Next, you’ll need to log in.

- Once you log into your Thrive Hub account, you should automatically direct to the Taxes page.

- Select the blue “Click here to file your taxes” hyperlink to start the tax eligibility questionnaire.

- Next, review the questionnaire purpose statement and accept it by selecting the start button in the bottom corner.

Step 3. Complete Thrive Hub Tax Questionnaire

- Enter all the required fields in the boxes.

- A link to Tax Slayer will pop up on the screen if you meet the eligibility requirements for free tax filing with SC Thrive. (NOTICE: You must enter Tax Slayer through this link to file for free)

- If you do not meet the eligibility requirements for free tax filing with SC Thrive, a link to other tax filing services will pop up on the screen.

- Keep the Thrive Hub tab open for later use as you begin to enter Tax Slayer.

Step 4. Create a Tax Slayer Account

- Click on the File Taxes button to open Tax Slayer. A pop-up will remind you that you are leaving Thrive Hub to open Tax Slayer. Click Agree to continue.

- Next, create an account in Tax Slayer. If you already have an account, log in and skip to step 6! Using the same username and password you used for Thrive Hub is helpful.

- You will have to verify your Tax Slayer account through an email or cell phone number, so make sure you have access to either of these tools to verify. After confirming the account, you will see a screen that your account was successfully created.

Step 5. Accept the Tax Slayer User Agreement

- Sign the Tax Slayer disclosure after reading and verifying that you do agree to the Tax Slayer’s use of information agreement.

Step 6. Enter Your Information & Follow the Prompts

- Starting with personal information, enter your data into Tax Slayer by filling in each required field.

- When it asks if you would like to use Quick File, select I don’t know which forms I need if you would like help selecting your forms.

- The next screen asks if you want to select your forms or be guided. Select I want to be guided and continue to start inputting federal income tax information.

- Follow the process in the previous step for deductions and follow the prompts on the screen to go through Other Taxes, Payments & Estimates, and Miscellaneous Forms.

- Follow the Prompts for the Health Insurance section.

- If applicable, add the South Carolina state return and follow the prompts on the screen to complete the return.

Step 7. Verify & Start E-Filing

- Go through the summary and verify that the information is correct. You can also click Print or View/Download your return on the Tax Return Summary screen. You will need this information for your records and the Thrive Hub follow-up survey.

- You may have to verify the Tax Slayer account again with an email or text message.

- Select which method you would like to receive your refund. You can choose direct deposit or mail.

- If you are not e-filing, follow the instructions to access complete printed tax return forms.

- Select continue under Products and Services. It should not charge you for services because you are filing through Thrive Hub.

Step 8. Banking & ID Information

- As applicable, submit your required banking information to get a direct deposit.

- Enter your ID credentials (State ID or Driver’s License).

Step 9. Verify & Save

- Continue the e-file process by verifying your identity with AGI/PIN information or creating a new 5-digit PIN for this year. Keep this number for your records.

- Next, Select File and Sign my return, then select File now to file your taxes electronically.

- You are encouraged to keep a copy of your tax return for your records. Make sure you confirm that the IRS has accepted your federal return so you can address any issues that may have come up if rejection occurs. After that, ensure you have your login information. Now you are done.

Step 10. Enter Follow-up Info to Thrive Hub

- Return to the Thrive Hub tab.

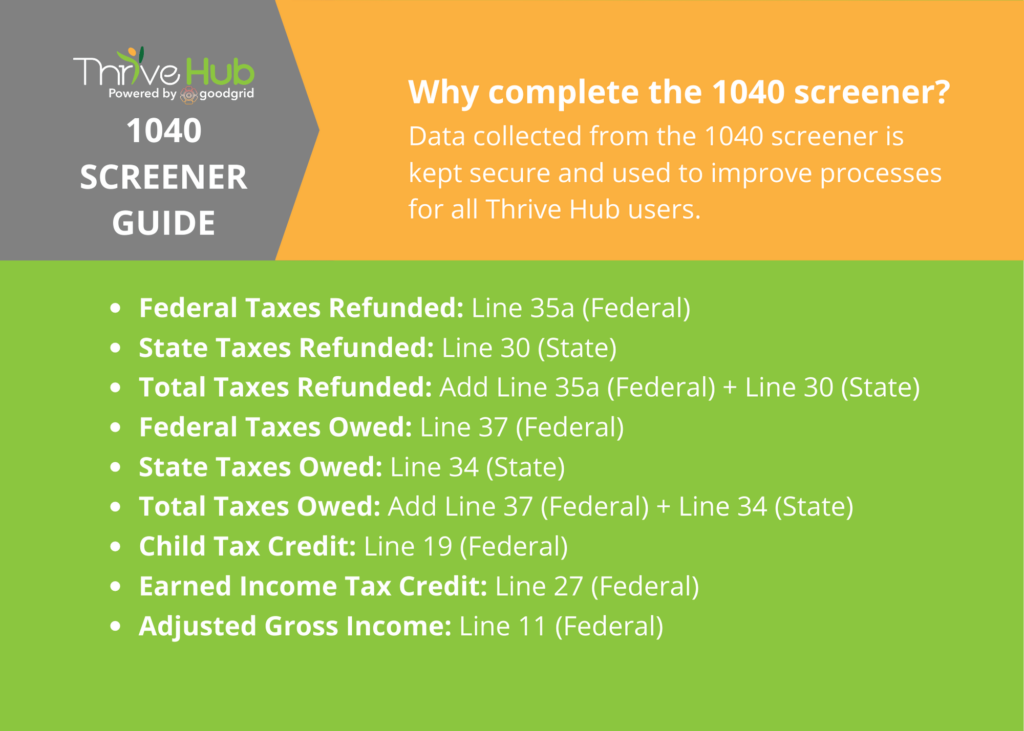

- Enter the information from your 1040 form into the spaces in Thrive Hub.

- Use the guide below to quickly find where each tax total is on your 1040 form.